Insightful Tidbits

Explore a variety of interesting topics and trending news.

Whole Life Insurance: A Financial Love Affair You Can't Break Up With

Unlock the secrets of whole life insurance—your ultimate financial partner for life! Discover why breaking up is never an option.

Understanding Whole Life Insurance: Is It Right for You?

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. One of the main features of this insurance is its cash value component, which accumulates over time. Unlike term life insurance, which offers coverage for a specific period, whole life insurance ensures that your beneficiaries receive a benefit upon your passing, regardless of when that occurs. This can provide peace of mind, knowing that your loved ones will be financially supported in the event of your untimely death.

When considering whether whole life insurance is right for you, it’s essential to evaluate your financial situation and long-term goals. Whole life policies typically come with higher premiums compared to term policies but can serve as a stable investment vehicle due to their cash value growth. Factors such as age, health, and financial objectives should all play a role in your decision-making process. Here are some key points to consider:

- Do you need lifelong coverage?

- Are you comfortable with higher premium payments?

- Would you benefit from the cash value component?

The Benefits of Whole Life Insurance: More Than Just a Policy

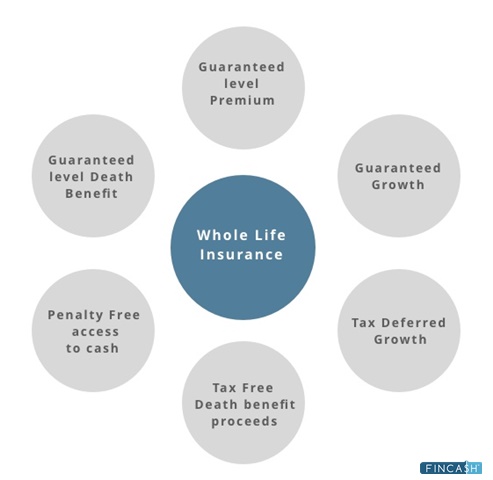

Whole life insurance offers a myriad of benefits that extend well beyond the basic coverage of a traditional life insurance policy. Unlike term life insurance, which is designed to provide coverage for a specific period, whole life insurance is a permanent solution. This means that as long as you continue to pay your premiums, your coverage will remain in effect for your entire life. One of the most notable advantages is the cash value component, which accumulates over time and can be borrowed against or withdrawn in times of need. This feature not only provides financial security but also acts as a forced savings plan, helping you build wealth while ensuring your loved ones are protected.

Additionally, whole life insurance can serve as a strategic financial tool for estate planning. The death benefit provided by the policy is generally tax-free, allowing your beneficiaries to inherit a substantial sum without the burden of taxation. Furthermore, the predictability of whole life insurance premiums means that you can effectively budget for the long term, making it easier to anticipate and manage your financial commitments. Whether you're considering it for personal security or as an investment, the multifaceted benefits of whole life insurance make it much more than just a policy—it's a cornerstone of financial stability and peace of mind.

Whole Life Insurance vs. Term Life Insurance: What's the Best Choice for Your Financial Future?

When considering your financial future, choosing between Whole Life Insurance and Term Life Insurance is crucial. Whole Life Insurance provides lifelong coverage and includes a cash value component, allowing you to accumulate savings over time. On the other hand, Term Life Insurance offers coverage for a specific period (typically 10-30 years) and is generally more affordable. This makes it an attractive option for those who require temporary coverage to protect their families during critical years, such as while paying off a mortgage or funding children’s education.

Ultimately, the choice between Whole Life Insurance and Term Life Insurance depends on your individual financial goals and circumstances. If you are looking for an investment component and lifelong protection, then Whole Life Insurance may be the best choice for you. Conversely, if you seek cost-effective coverage with the flexibility to invest elsewhere, Term Life Insurance could be the better option. Consider your current needs, long-term financial goals, and consult with a financial advisor to determine the most suitable plan.